2021 FICA Tax Rates

Por um escritor misterioso

Descrição

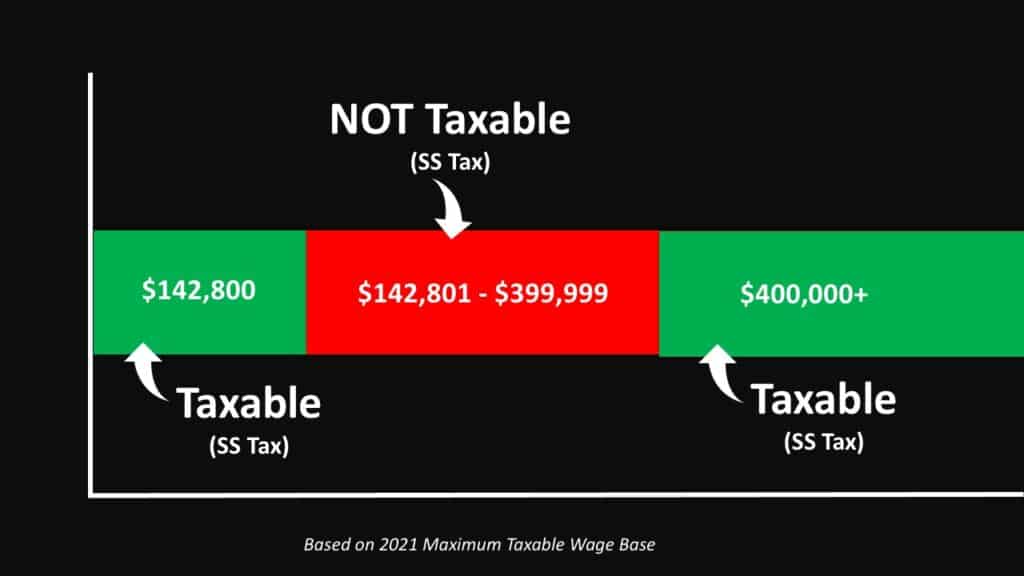

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

What is FICA Tax? - Optima Tax Relief

Do You Have To Pay Tax On Your Social Security Benefits?

Employers: The Social Security Wage Base is Increasing in 2022

2023 FICA Tax Limits and Rates (How it Affects You)

Inflation Spikes Social Security Checks for 2022 - Baker Holtz

Social Security Administration Announces 2022 Payroll Tax Increase

Financial Considerations for Moonlighting Physicians

The Myth of Fixing Social Security Through Raising Taxes – Social Security Intelligence

FICA Tax in 2022-2023: What Small Businesses Need to Know

What Is Medicare Tax? Definitions, Rates and Calculations - ValuePenguin

Medicare tax: Diving Deep into W2 Forms: Uncovering Medicare Taxes - FasterCapital

What are the major federal payroll taxes, and how much money do they raise?

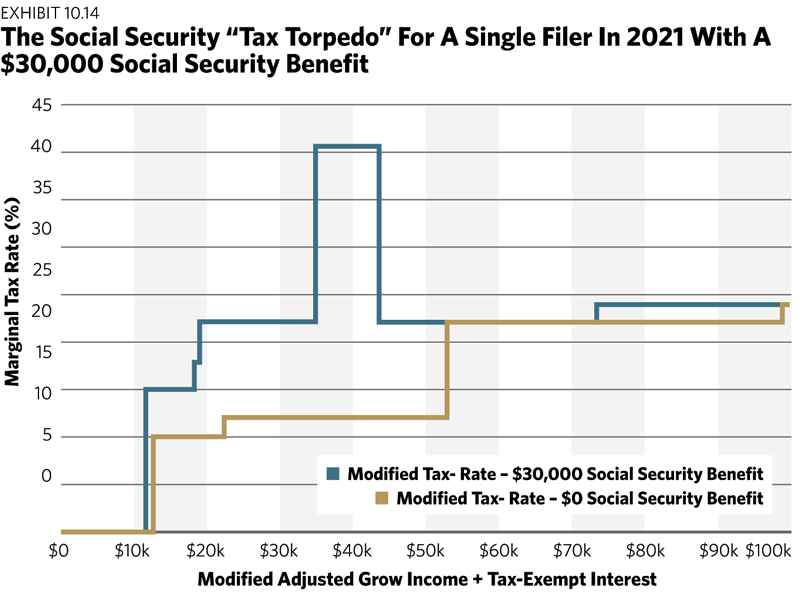

Avoiding The Social Security Tax Torpedo

de

por adulto (o preço varia de acordo com o tamanho do grupo)