Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

Publication 970 - Introductory Material Future Developments What's New Reminders

Publication 970 (2022), Tax Benefits for Education

Education tax credits: Maximizing Savings with IRS Pub 970 - FasterCapital

Maximum 2023 Educator Expenditure Deduction is $300

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

How College 529 Savings Account Withdrawals Are Taxed & Why You May NOT Want to Use a 529 Plan Altogether - Lifetime Paradigm

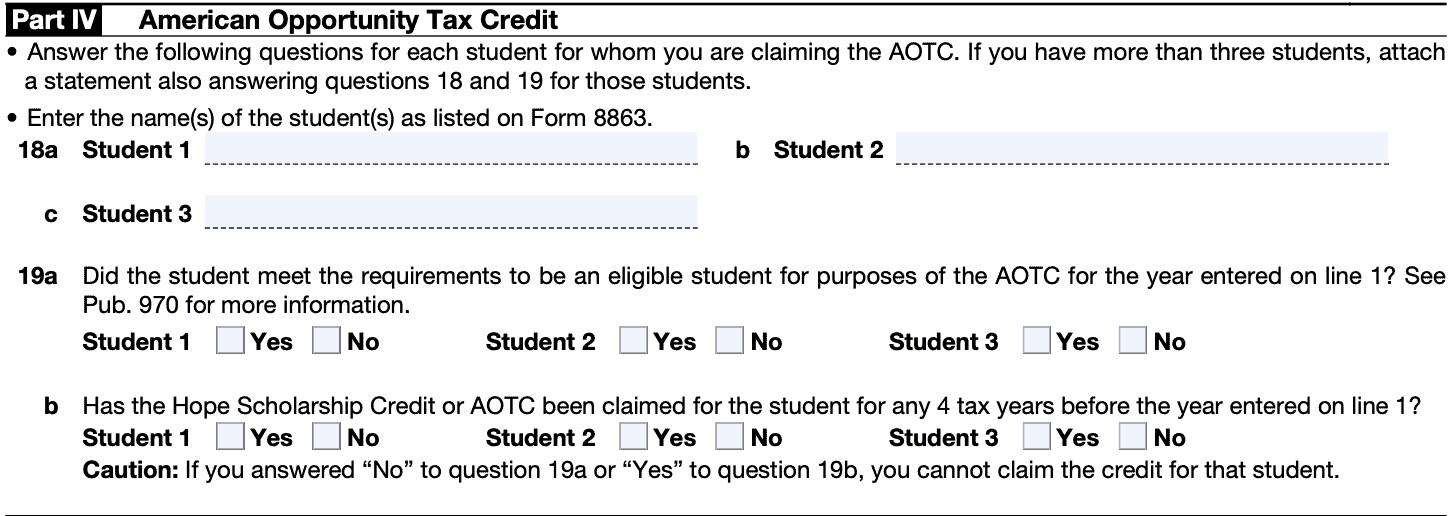

IRS Form 8862 Instructions

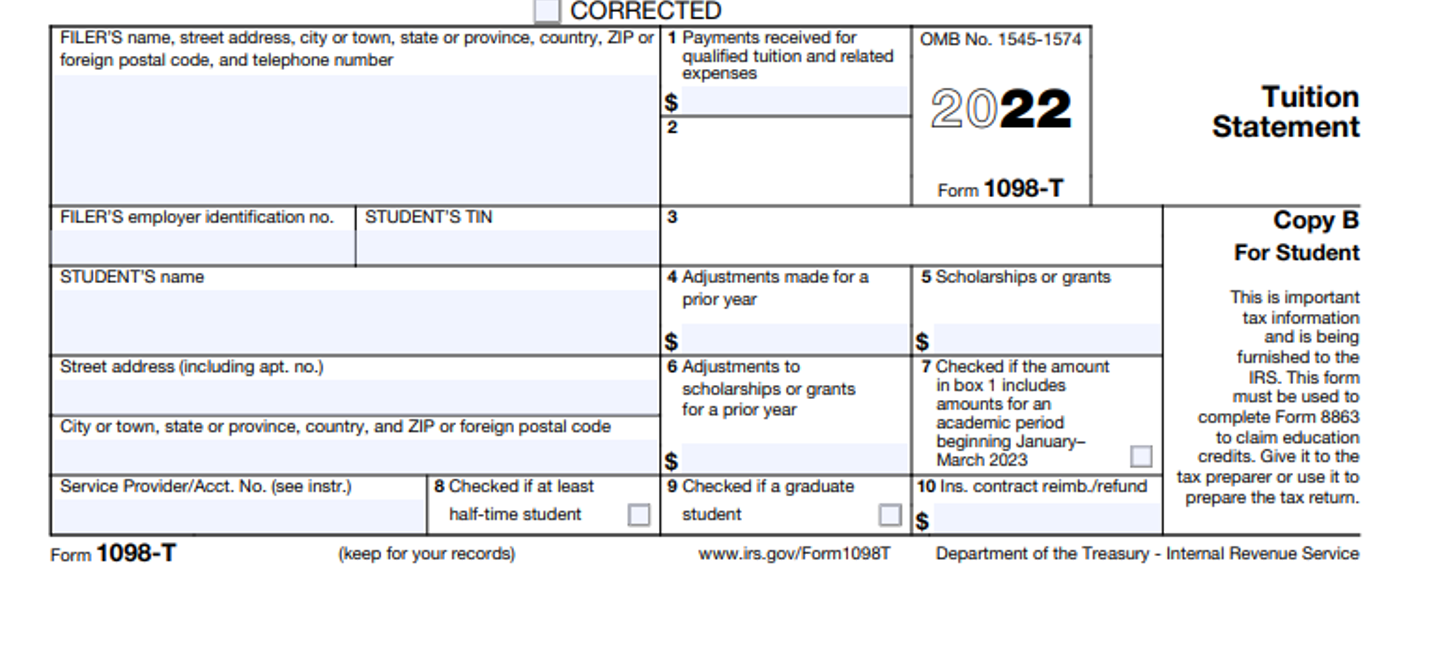

IRS 1098-T Tax Form for 2022

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

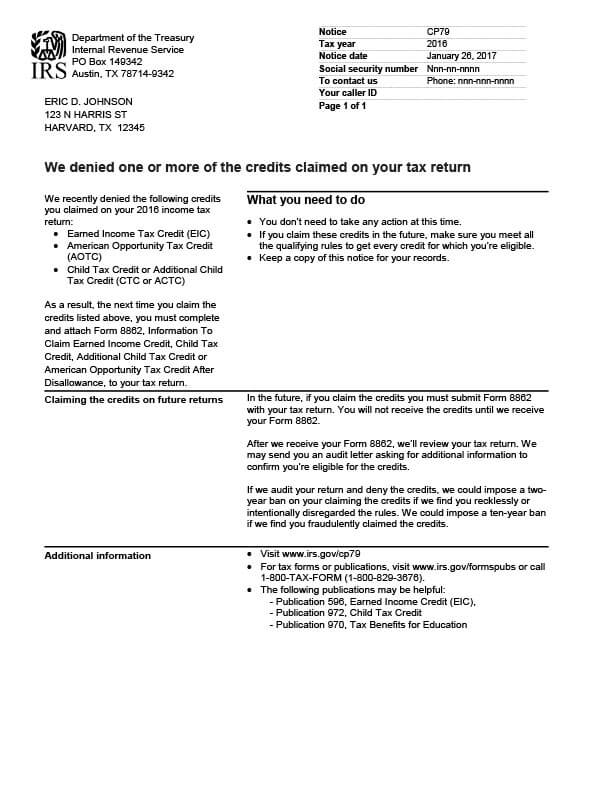

IRS CP 79- We Denied One or More Credits Claimed on Your Tax Return

Education tax credits: Maximizing Savings with IRS Pub 970 - FasterCapital

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

IRS Notice CP79 - Tax Defense Network

IRS Form 1098-T, Enrollment Services (RaiderConnect)

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

The 2 Education Tax Credits for Your Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)