How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

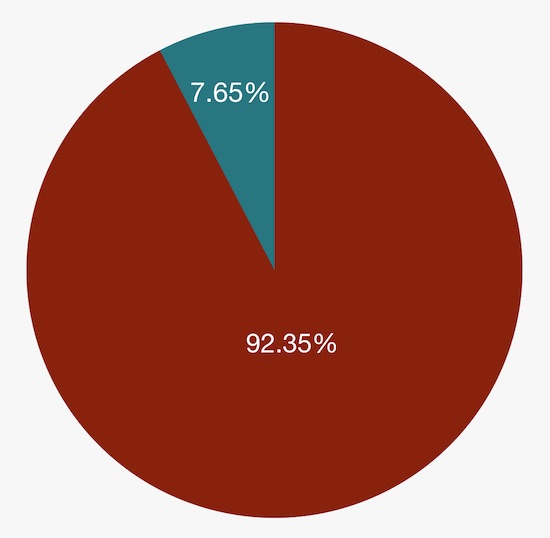

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

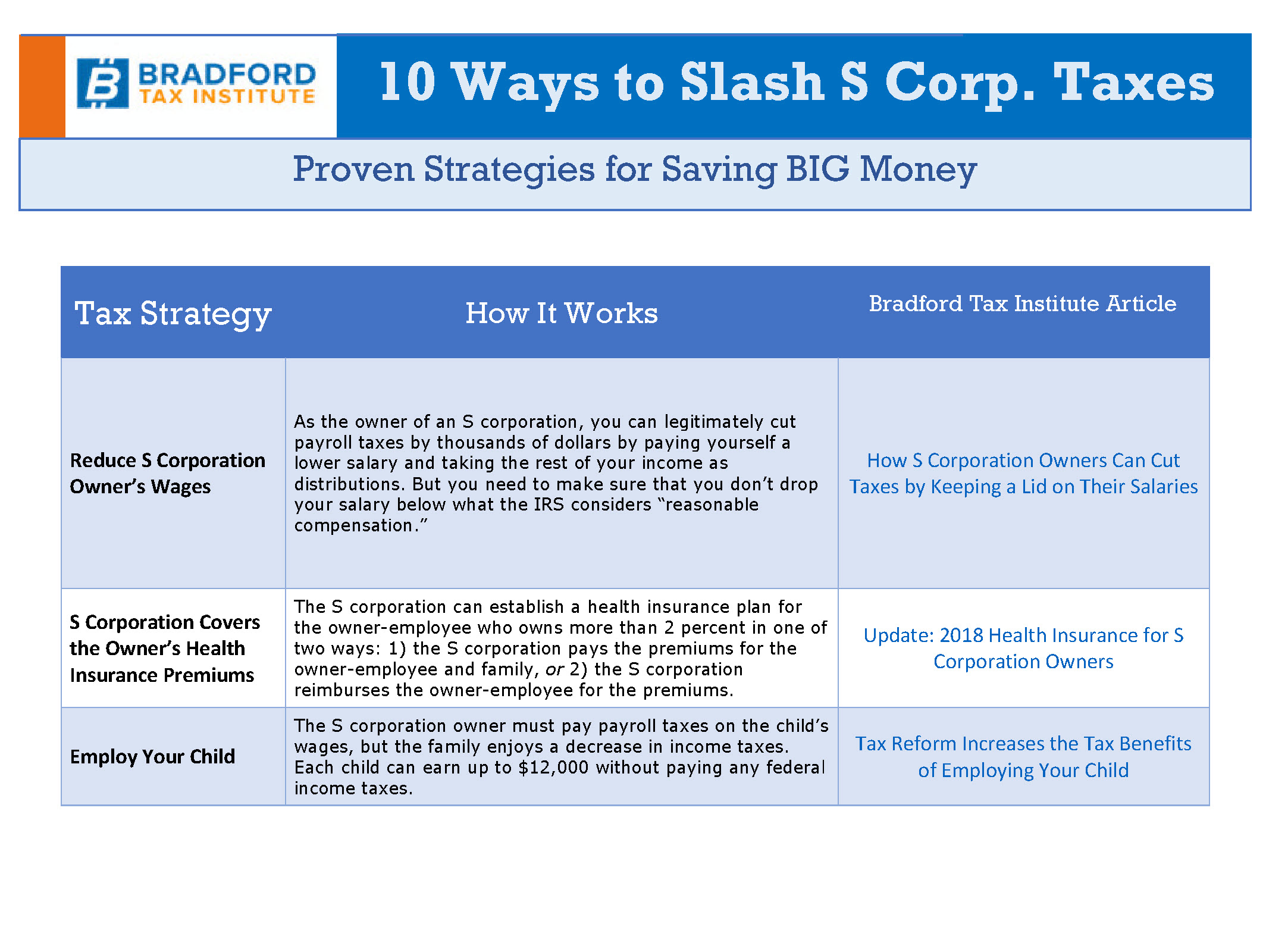

Benefits of the S-Corporation Election

How to File Self-Employment Taxes: A Step-by-Step Guide

S Corp - A Comprehensive Guide to Filing Taxes

The Practical Guide to S Corporation Taxes - Lifetime Paradigm

S Corporation vs. LLC: Differences, Benefits

Tax Foundation Needs to Fix Their Map - The S Corporation Association

LLC or S Corp for My Business?

Current developments in S corporations

How an S-Corp Can Reduce Your Self-Employment Taxes - TurboTax Tax Tips & Videos

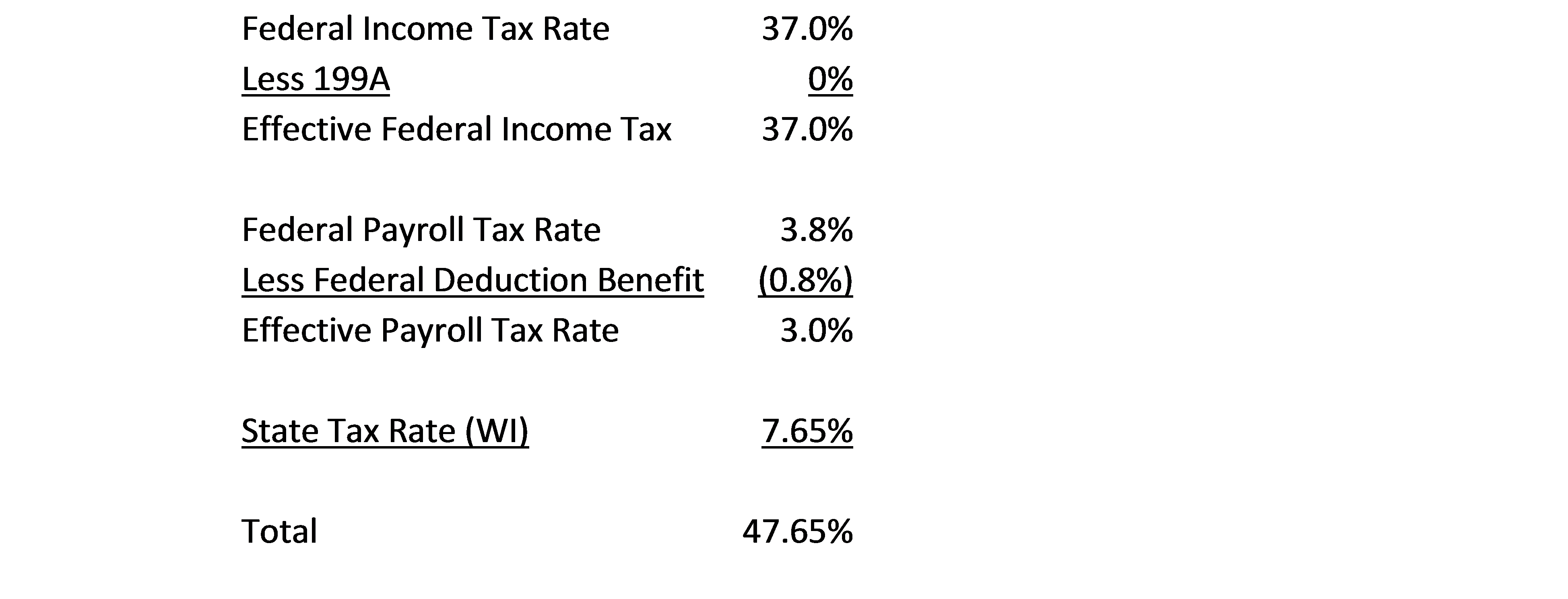

Using an S corporation to avoid self-employment tax

S Corp vs LLC: Selecting a Business Structure — SLATE ACCOUNTING + TECHNOLOGY

Avoid Self Employment Tax - S Corp Election - Reduce SE Tax - WCG CPAs & Advisors

S CORP TO MITIGATE FEDERAL EMPLOYMENT TAX BILLS

Why You Should Form an S Corporation (and When)

de

por adulto (o preço varia de acordo com o tamanho do grupo)