CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Por um escritor misterioso

Descrição

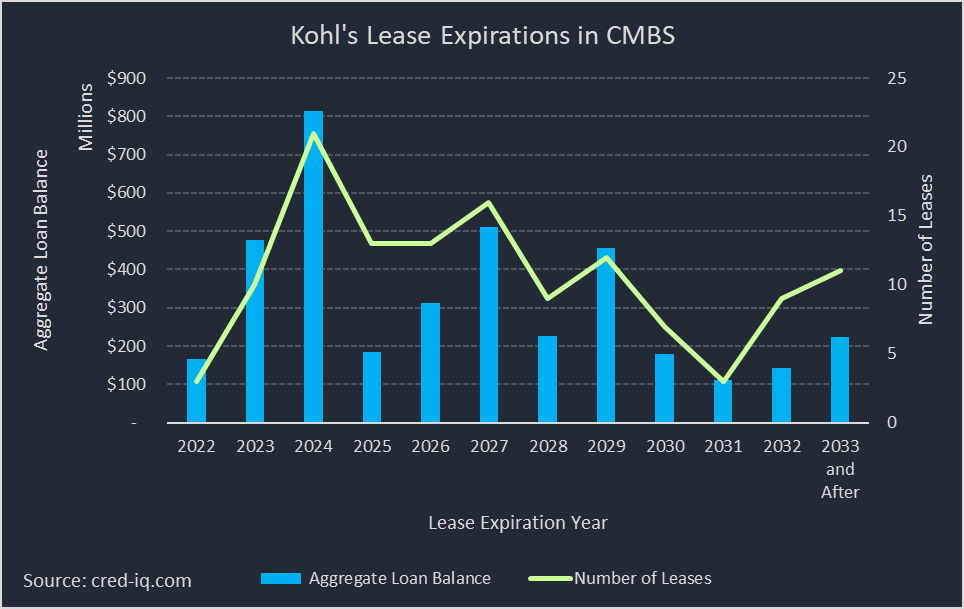

Key Takeaways: Kohl’s plans to open smaller stores and transition away from department store formatThe highest concentration of Kohl’s lease expirations occurs in 2024 impacting $815 million in CMBS debtCMBS exposure to Kohl’s totals approximately $5 billion Speculation surrounding Kohl’s and its future as a public company has been active during Q1 2022. In early-March

BMO Commercial Mortgage Securities LLC Form 424H Filed 2023-01-17

CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Wells Fargo Commercial Mortgage Trust 2016-C37

The E-Commerce Takeover: Why Department Stores Are Struggling This Holiday Season, by Stephanie Hughes

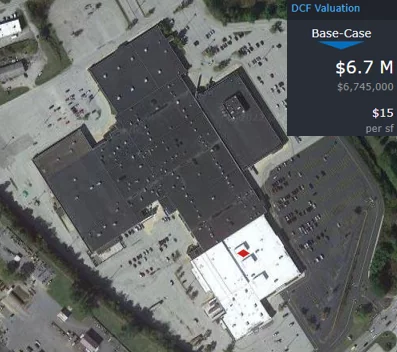

What real estate risks mean for commercial mortgage-backed securities

Kohl's Doubles Down On Bricks And Mortar In Face Of Pressure From Activist Investors

Lock In Your Bets: 22 Commercial Real Estate Trends To Expect In 2018

Press Release Archives - Page 2 of 10 - Mission Capital

A Real-Estate Haven Turns Perilous With Roughly $1 Trillion Coming Due - WSJ

CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Brookfield Defaults on $77MM Loan for Bellis Fair Mall - The Registry

4-28-17

Annual Real Estate Investment Report - Greater Boston by The Real Reporter - Issuu

2010 Global Market Report - NAI Commercial Real Estate

Future of Cottonwood Mall in the hands of a court-appointed receiver - Albuquerque Business First

de

por adulto (o preço varia de acordo com o tamanho do grupo)