FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

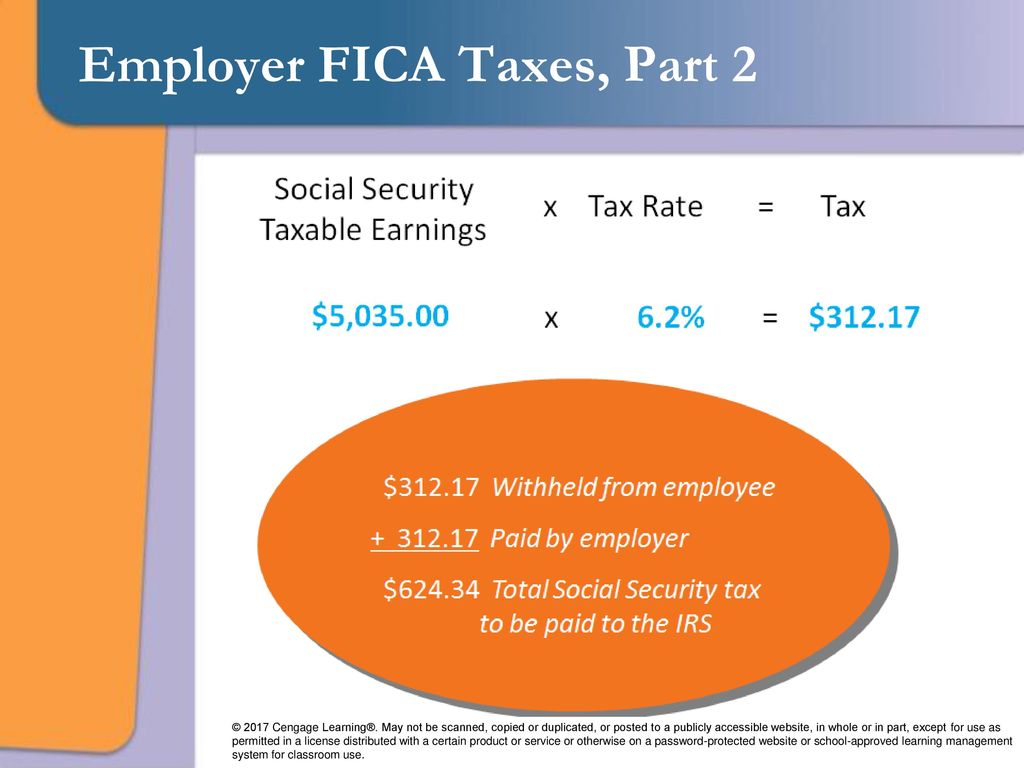

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

Chapter 9 Payroll Accounting: Employer Taxes and Reports. - ppt download

What are FICA Taxes? 2022-2023 Rates and Instructions

What is payroll tax?

Am I Exempt from Federal Withholding?

NerdWallet App

50/30/20 Budget Calculator - NerdWallet

How to Pay Freelance Work Taxes in 2023

What are FICA Taxes? 2022-2023 Rates and Instructions

Hiring Contract vs. Full-Time Workers - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

What Is FICA Tax? A Complete Guide for Small Businesses

How to Ask for a Raise in an Uncertain Economy - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

IRS Business Forms: A Comprehensive List - NerdWallet

What are the major federal payroll taxes, and how much money do they raise?

de

por adulto (o preço varia de acordo com o tamanho do grupo)