What Is FICA Tax, Understanding Payroll Tax Requirements

Por um escritor misterioso

Descrição

FICA tax refers to the taxes withheld by employers for Social Security and Medicare. Learn more about the FICA tax and how it’s calculated.

According to the accountant of Ulster Inc., its payroll taxes for the week were as follows: $138.50 for FICA taxes, $18.50 for federal unemployment taxes, and $89.50 for state unemployment taxes. Jo

Payroll Taxes: What Are They and What Do They Fund?

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes and Employer Responsibilities

What are FICA Taxes? 2022-2023 Rates and Instructions

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Understanding payroll tax & how to calculate it

What Is FICA Tax?

FICA explained: Social Security and Medicare tax rates to know in 2023

The Ins and Outs of U.S. Payroll Requirements - What UK Businesses Need to Know

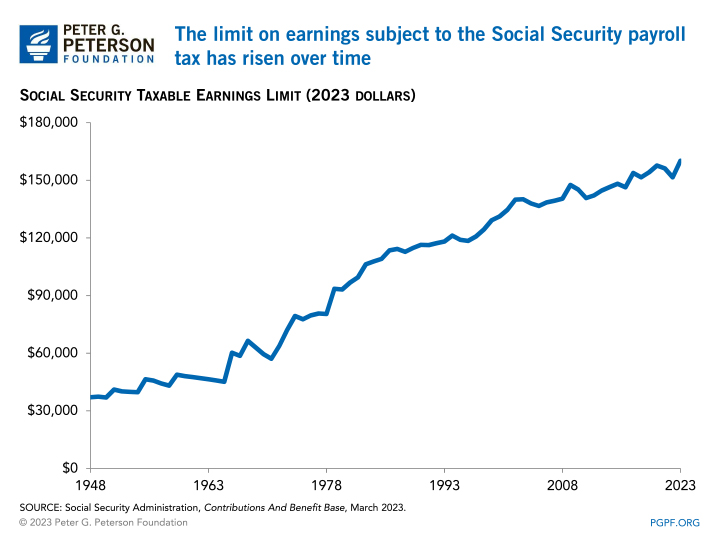

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Federal Insurance Contributions Act - Wikipedia

2020 Payroll Taxes Will Hit Higher Incomes

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)