Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Descrição

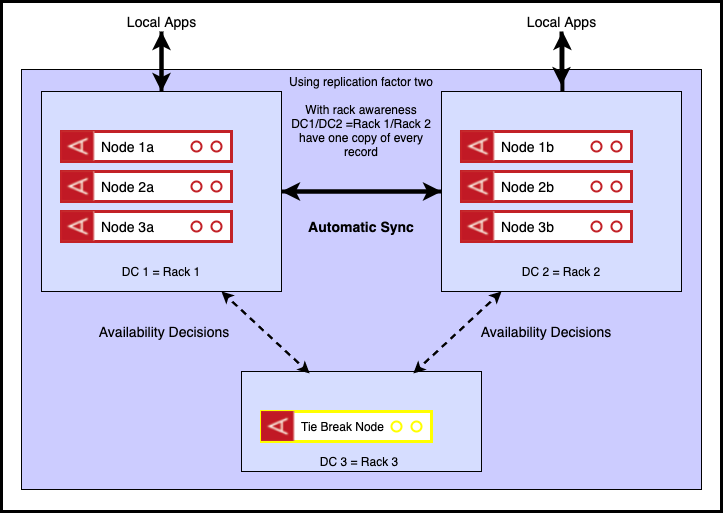

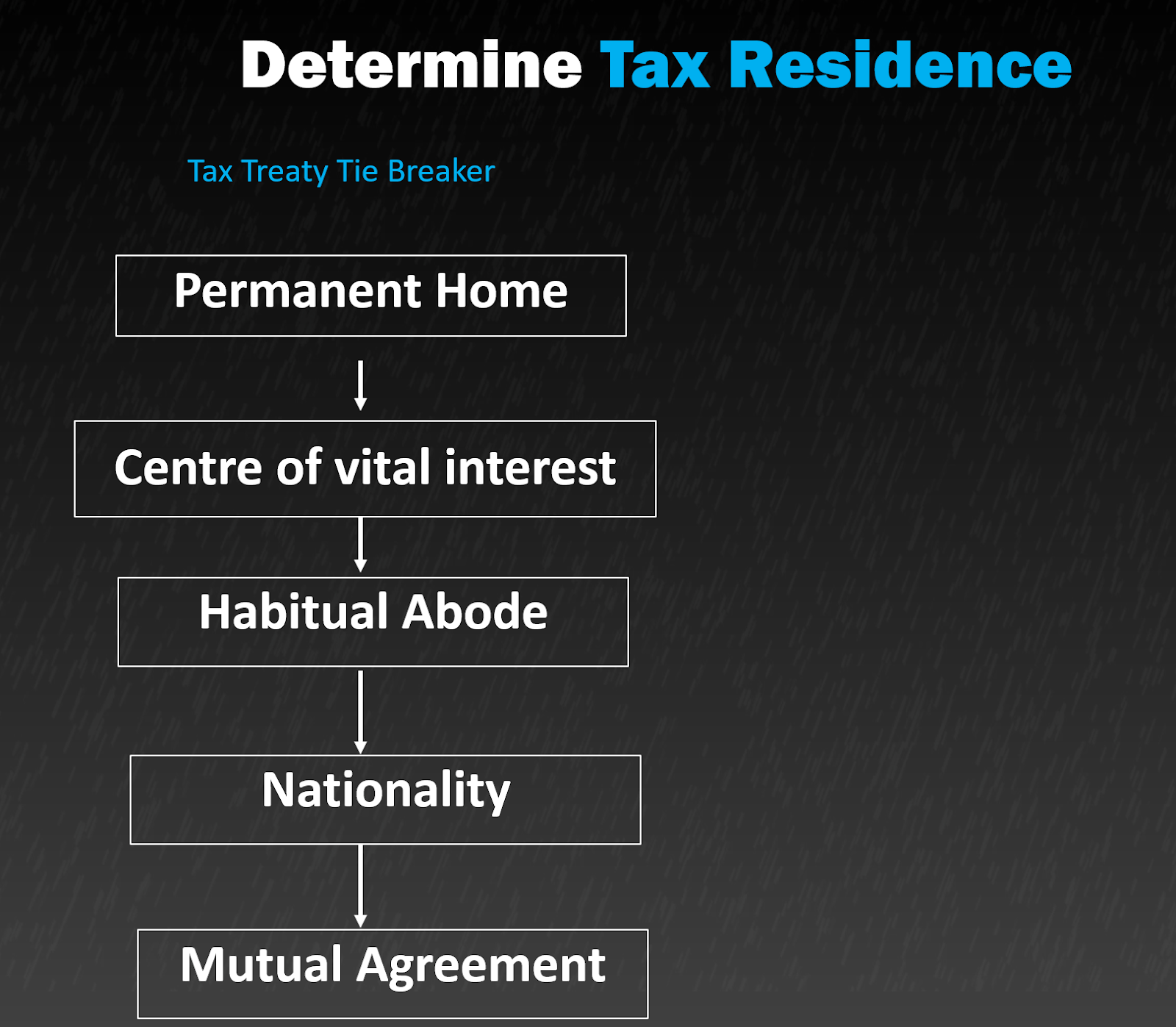

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

2023 International Tax Competitiveness Index

Tax Laws for U.S. Green Card Holders

Importance of Double Tax Agreements for Australian Expats

IRS Taxation and U.S. Expats - ppt download

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

Who Gets to Tax You? Tie Breaker Rules in Tax Treaties

Newcomers to Canada Newcomers to Canada. - ppt download

THE IMPACT OF THE COMMUNICATIONS REVOLUTION ON THE APPLICATION OF PLACE OF EFFECTIVE MANAGEMENT AS A TIE BREAKER RULE - PDF Free Download

Global minimum tax? A rundown of the Pillar Two model rules

The Evolving Global Mobility Landscape Tax Considerations

Tie Breaker Rule in Tax Treaties

Unraveling the United States- People's Republic of China Income Tax Treaty

de

por adulto (o preço varia de acordo com o tamanho do grupo)