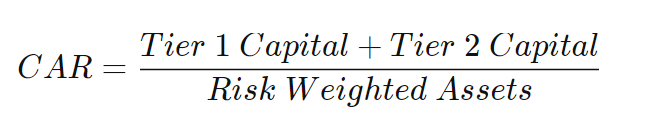

Tier 1 Capital Ratio: Definition and Formula for Calculation

Por um escritor misterioso

Descrição

The tier 1 capital ratio is the ratio of a bank’s core tier 1 capital—its equity capital and disclosed reserves—to its total risk-weighted assets.

Tier 1 Capital, Definition, Purpose & Ratio - Video & Lesson Transcript

What Is the Tier 1 Capital Ratio?

Capital Adequacy Requirements (CAR) Chapter 1 – Overview of Risk-based Capital Requirements

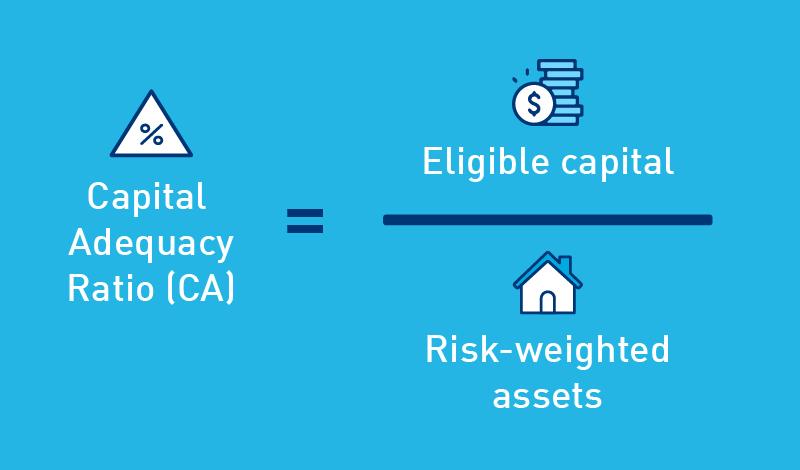

What is Capital Adequacy Ratio?

Regulatory Capital Ratio: How Tier 1 Capital Plays a Vital Role - FasterCapital

Capital Adequacy Ratio: CRAR Full form, Ratio and Formula

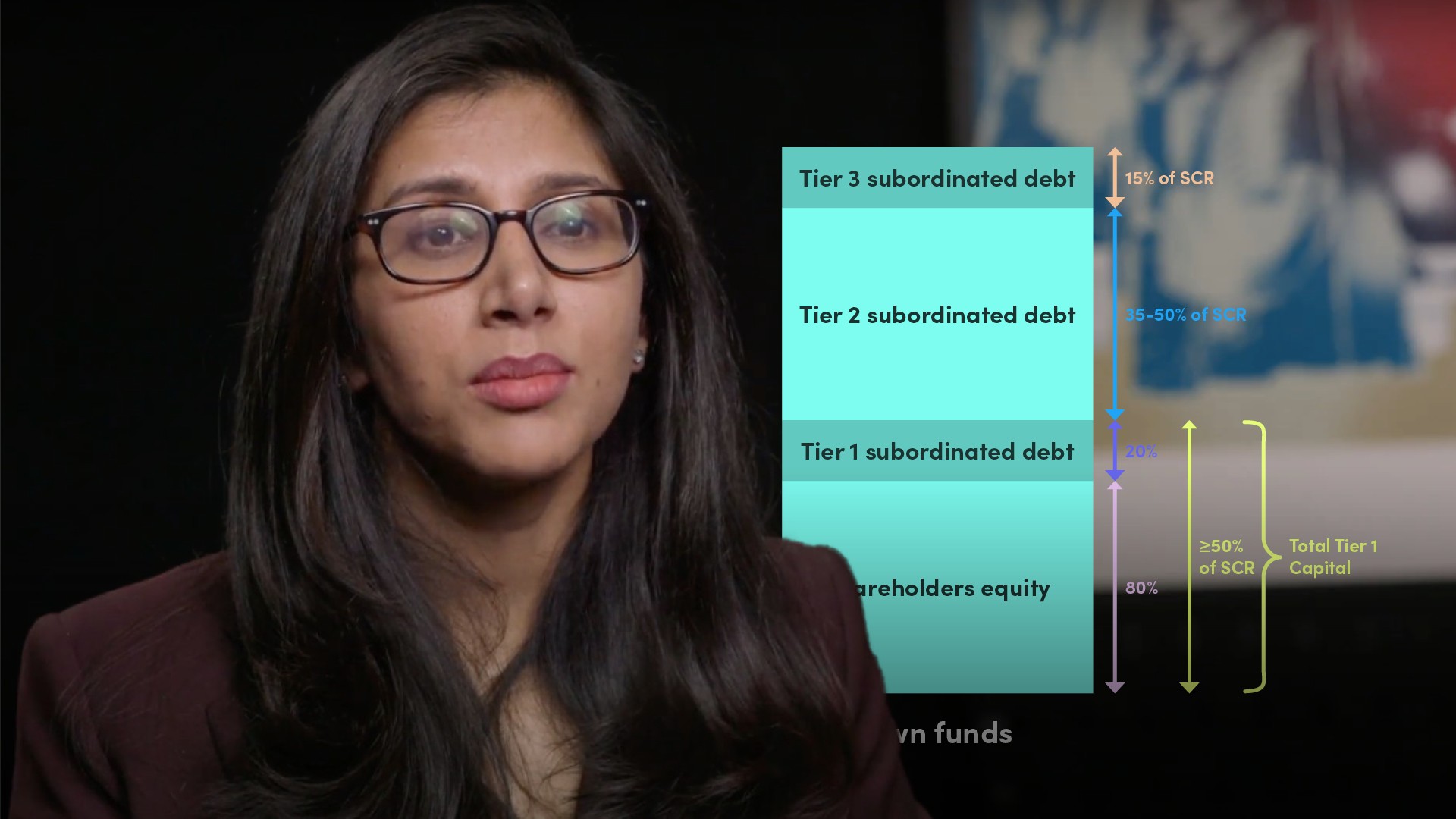

EU Solvency II Capital Requirements Illustration - Finance Unlocked

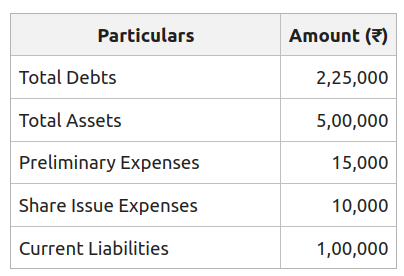

Total Assets to Debt Ratio: Meaning, Formula and Examples - GeeksforGeeks

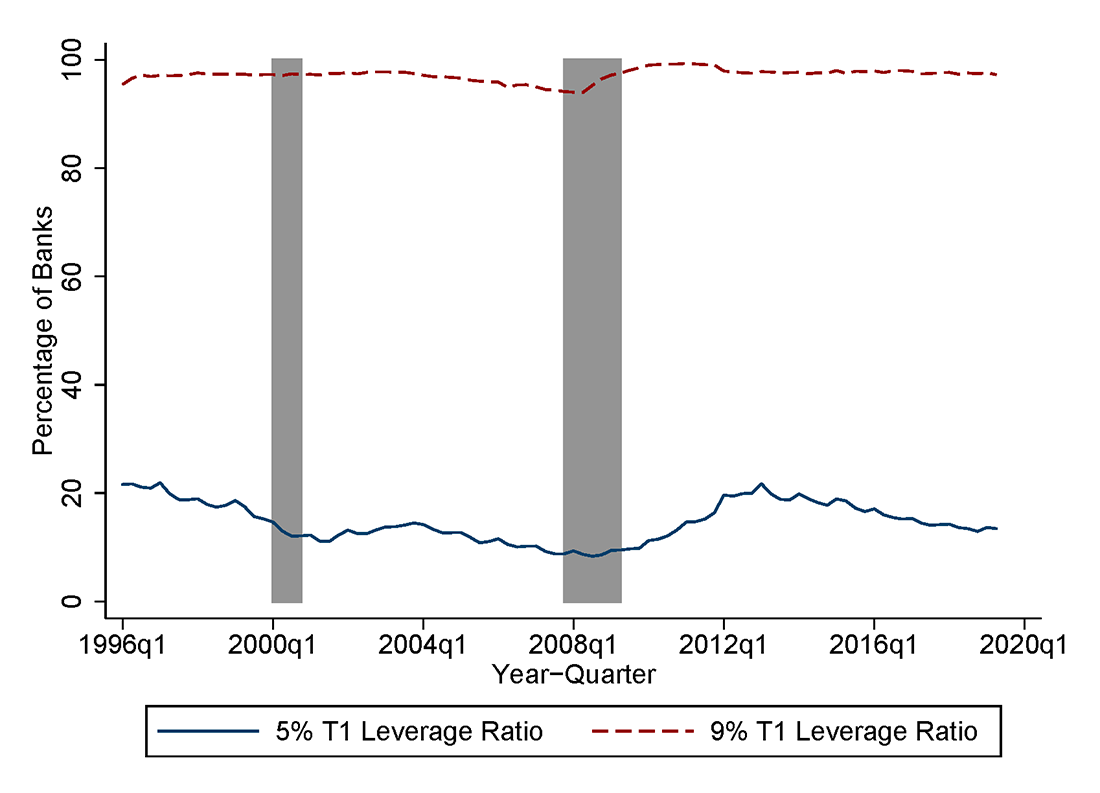

The Fed - Analyzing the Community Bank Leverage Ratio

APRA Explains: Risk-weighted assets

Calculate Leverage and Coverage Ratios

de

por adulto (o preço varia de acordo com o tamanho do grupo)