Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Employers responsibility for FICA payroll taxes

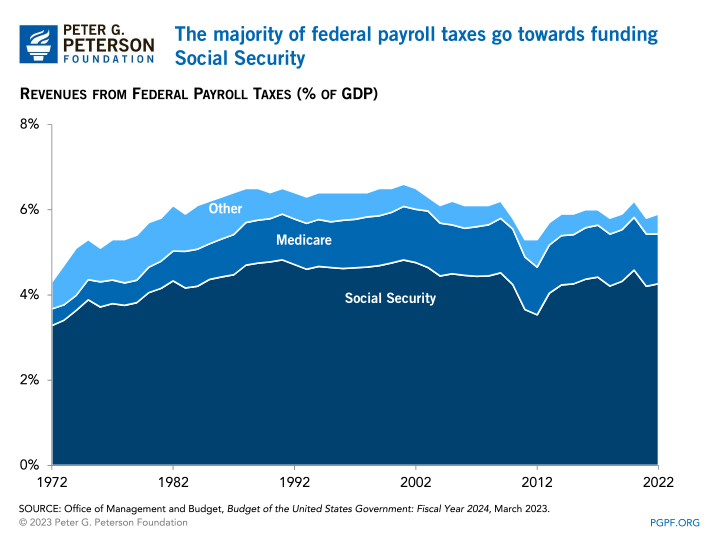

Payroll Taxes: What Are They and What Do They Fund?

Understanding pre vs. post-tax benefits

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age

2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes

Publication 505 (2023), Tax Withholding and Estimated Tax

Certified Payroll Services

Wage Base Limit - FasterCapital

Understanding Your Tax Forms: The W-2

What is payroll tax?

de

por adulto (o preço varia de acordo com o tamanho do grupo)