Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Descrição

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

Mastering Estimated Tax: Minimizing Underpayment Penalties - FasterCapital

Should I Be Making Estimated Tax Payments? - Financial Symmetry, Inc.

Safe harbors and other ways to avoid estimated tax penalties - Don't Mess With Taxes

Use These 3 Tips to Avoid Estimated Tax Penalties - SH Block Tax Services

Estimated Tax Payments Are Due: Four Things You Need to Know

IRS Underpayment Penalties and How to Avoid Them

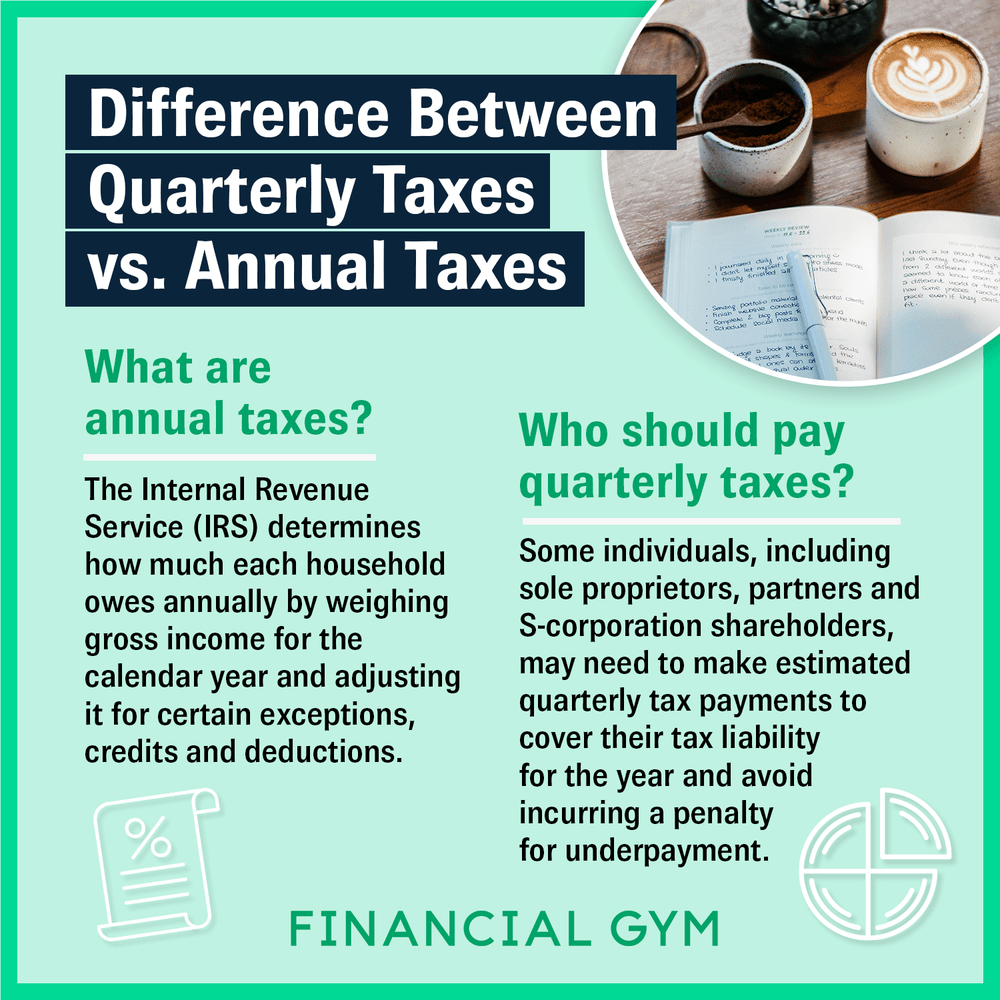

What's the Difference Between Quarterly Taxes vs. Annual Taxes?

Estimated Tax Penalty: The Correct Way to Make Estimated Tax Payments for 2021

Penalty for Underpayment of Estimated Tax & How To Avoid It - Picnic Tax

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/origin-imgresizer.eurosport.com/2023/10/24/3811232-77476568-2560-1440.jpg)