FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Por um escritor misterioso

Descrição

IRS Guideline: Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees What is FICA? FICA is the abbreviation of the Federal Insurance Contribution Act. The FICA tax is a United States federal payroll tax administered to both employees and employers to fund Medicare and Social Security. This means that when you…

Filing Your Non-Resident Tax Forms using Sprintax (F and J)

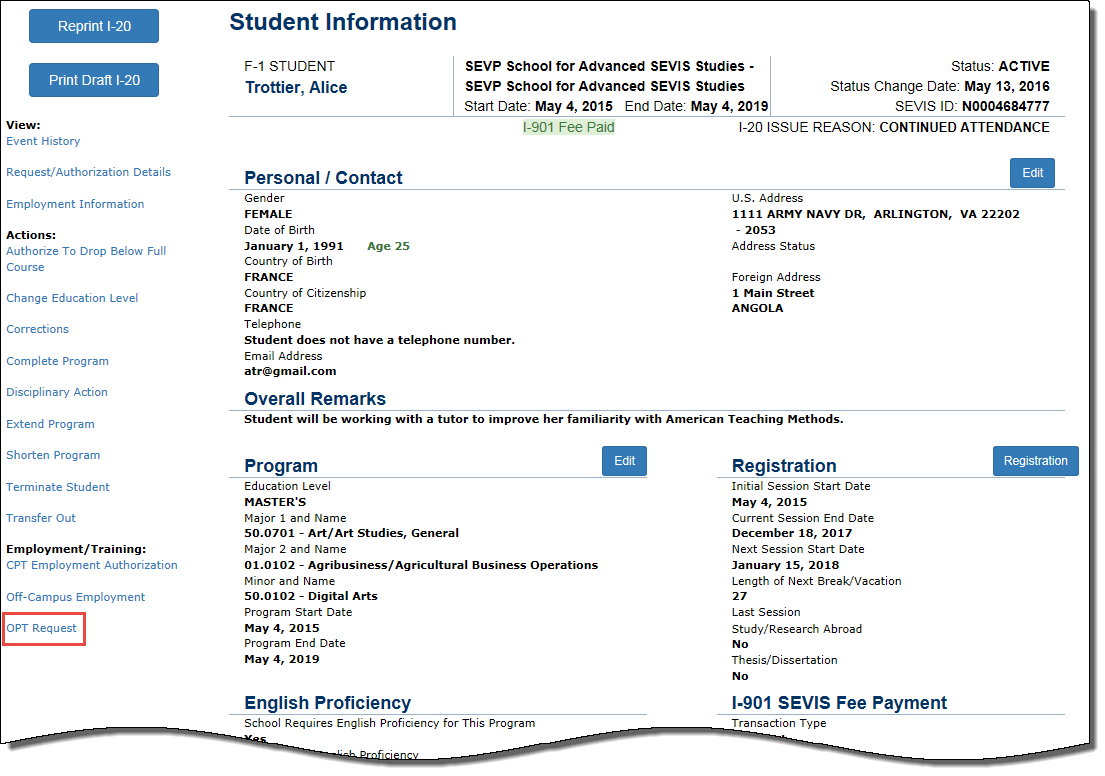

Residency status for F1 visa international students on OPT/CPT

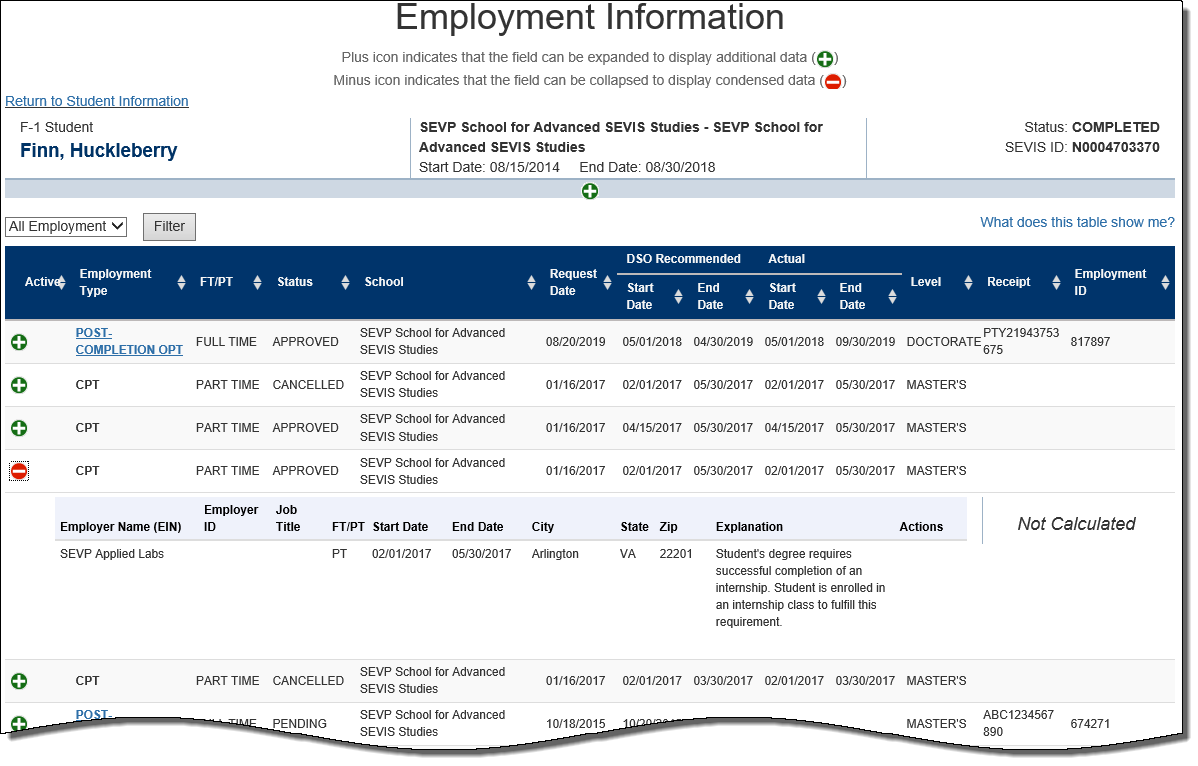

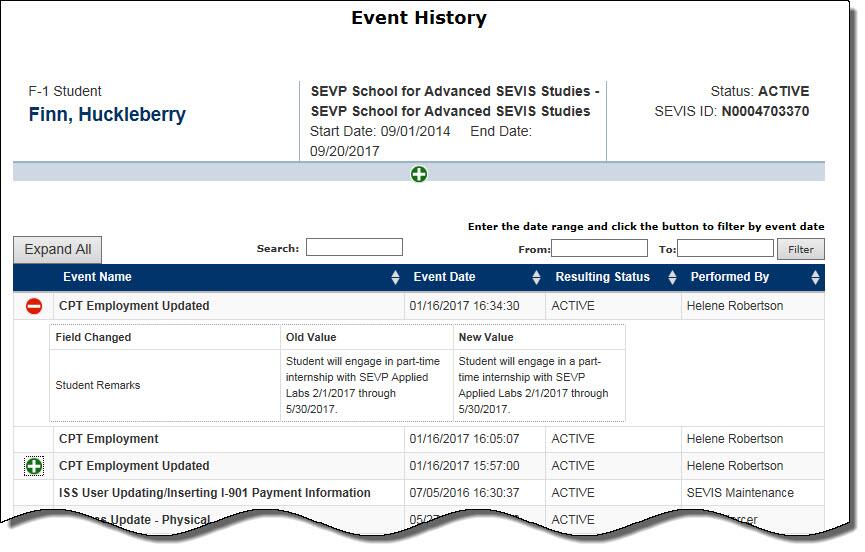

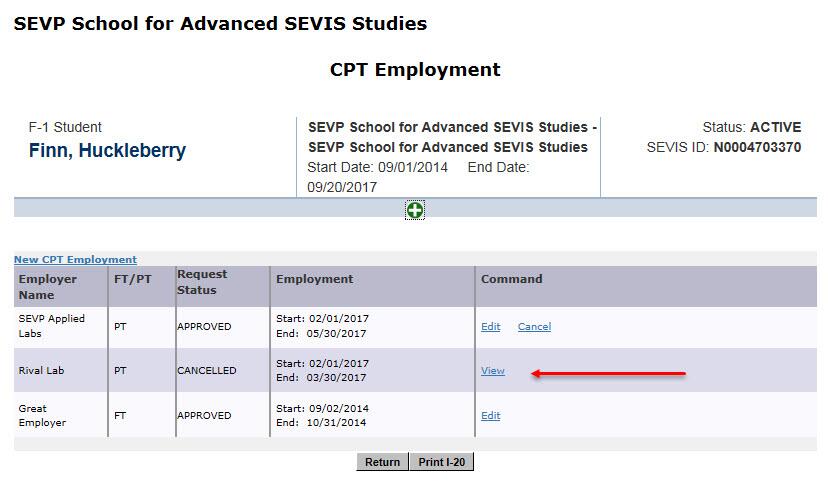

F-1 Curricular Practical Training (CPT)

OPT Student Taxes Explained

F-1 Curricular Practical Training (CPT)

F1 student in the US and eligible for FICA tax refund? We have

F-1 Optional Practical Training (OPT)

FICA Tax Exemption for Nonresident Aliens Explained

Income Tax International Student and Scholar Services

Sprintax Tax Preparation Software: Office of International Student

1040nra Delaware City DE

How to Earn Money on Student Visa in the US

F-1 Curricular Practical Training (CPT)

How does a student on an F1 OPT visa go about claiming a FICA

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

de

por adulto (o preço varia de acordo com o tamanho do grupo)