Tax holidays and profit-repatriation rates for FDI firms: the case of the Czech Republic

Por um escritor misterioso

Descrição

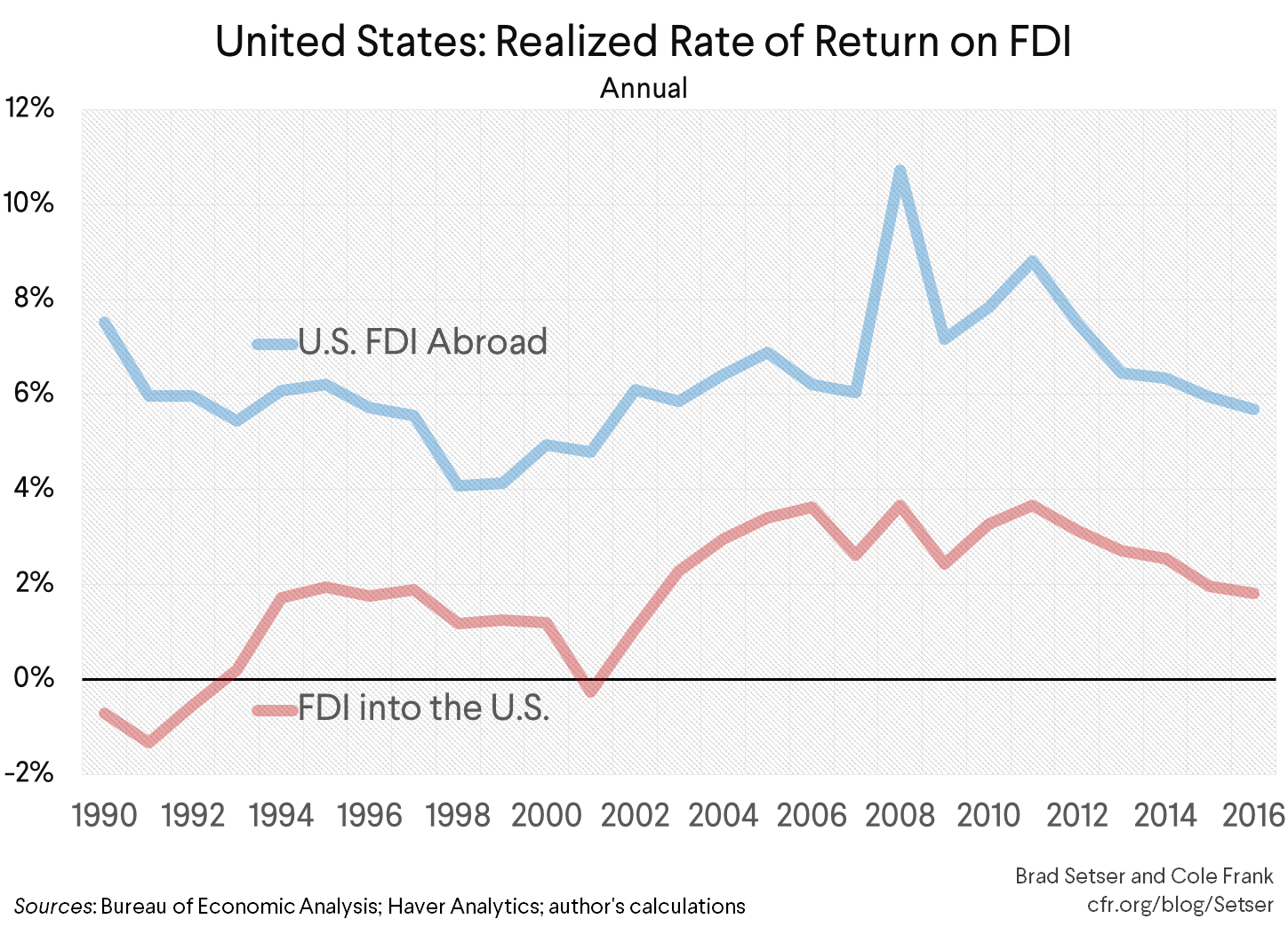

Tax Reform and the Trade Balance

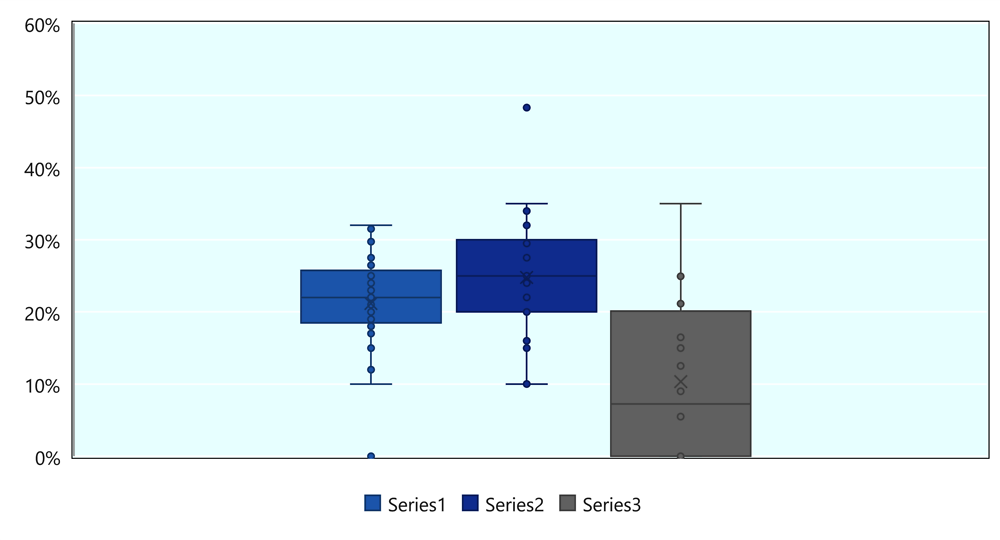

4. Investment Impacts of Pillar One and Pillar Two

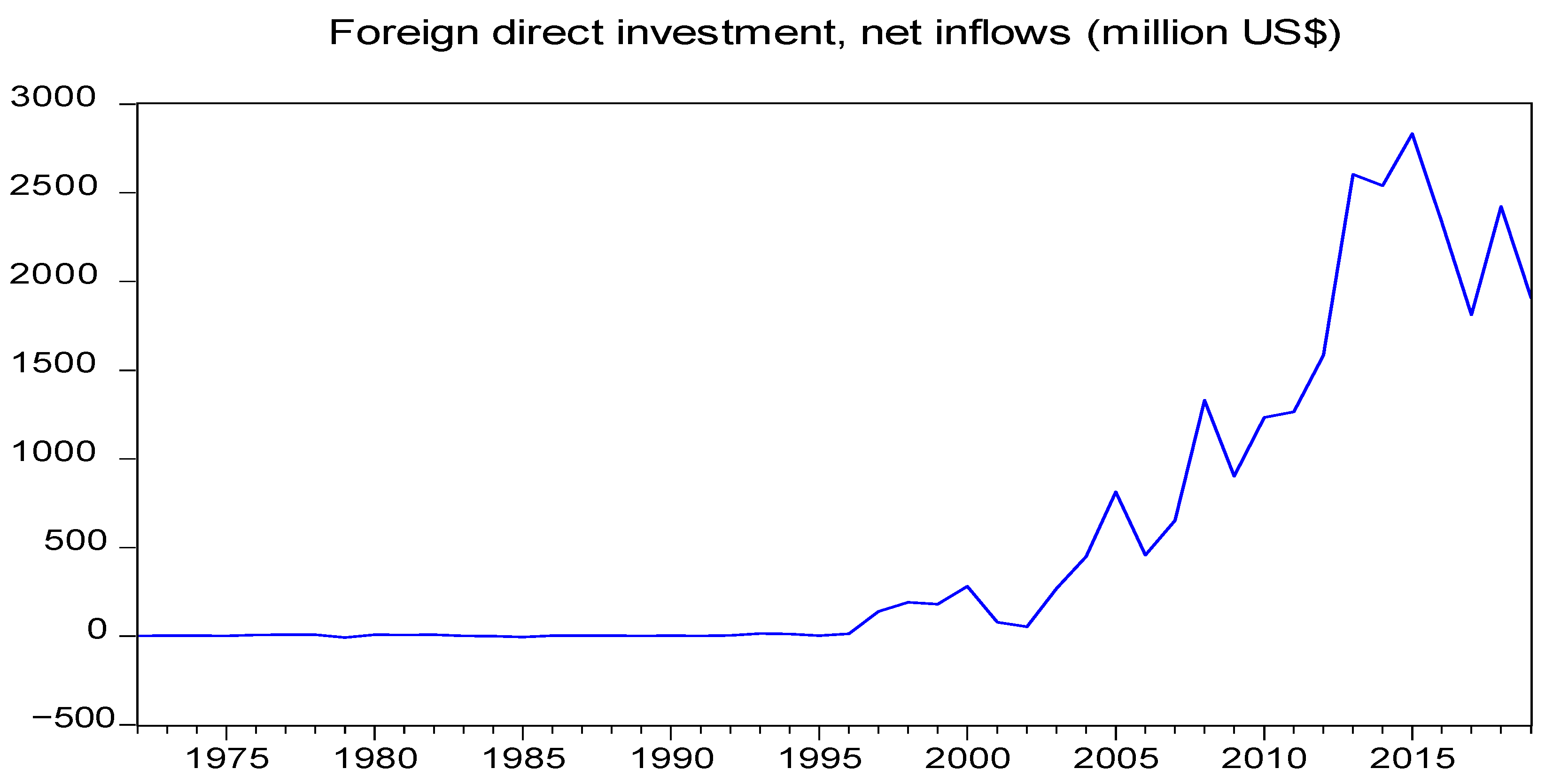

fdi inflows - FasterCapital

A Comparison of the Tax‐Motivated Income Shifting of

Foreign Holding Companies and the US Taxation of Foreign Earnings

Determinants of profit repatriation: Evidence from the Czech

IV Disinflation, Growth, and Foreign Direct Investment in

4. Investment Impacts of Pillar One and Pillar Two

Foreign Direct Investment in Southeastern Europe: How (and How

Foreign Direct Investment in New Member State of the EU and

Tax Incentives in Cambodia in: IMF Working Papers Volume 2018

Foreign Direct Investment in Southeastern Europe: How (and How

Economies, Free Full-Text

de

por adulto (o preço varia de acordo com o tamanho do grupo)

.jpg)