The advisory has directed taxpayers to check bank validation for

Por um escritor misterioso

Descrição

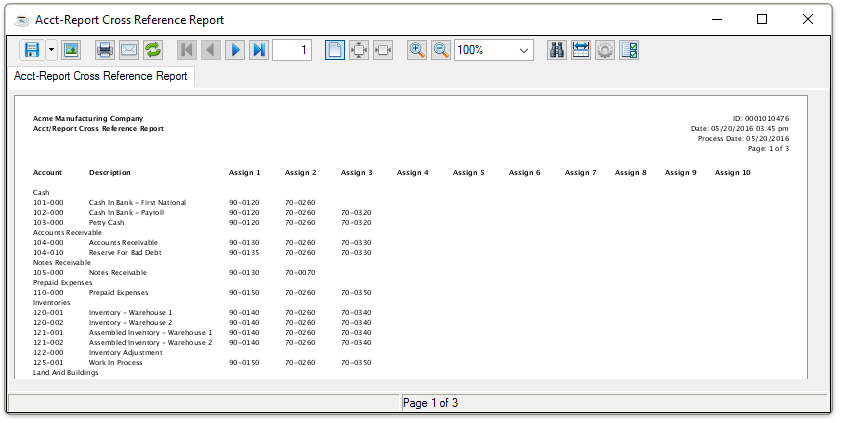

Jun 22, 2023 - The advisory has directed taxpayers to check bank validation for their GSTINs on the portal. The GSTN released the advisory on 24th April 2023, advising taxpayers to cross-check the bank account validation in GST. The taxpayer must take suitable action or wait, depending on the bank account validation status. Following are the types of bank account validation status- Success Failure Success with remark Pending for verification

Tax season 2022 will be an IRS nightmare. How to avoid refund delays and other headaches - CNET

)

Waiting For Your Income Tax Refund? CBDT Advises Taxpayers To Check Bank Account Validation Status - Learn How To Do It, Personal Finance News

Pre-Validate your Bank account for IT Refund

A Banking App Has Been Suddenly Closing Accounts, Sometimes Not Returning Customers' Money — ProPublica

Crypto tax glossary

5.19.1 Balance Due Internal Revenue Service

All about Bank Validation Status on GST Portal - Enterslice

Document

Tax Filing Support International Student and Scholar Services

Marcum 2023 Federal Tax Year in Review, Marcum LLP

Coronavirus Stimulus Checks: What To Expect

de

por adulto (o preço varia de acordo com o tamanho do grupo)