FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Por um escritor misterioso

Descrição

A guide to understanding the FICA tax, also called payroll tax - the mandatory deduction from your employee’s payroll. Know your FICA tax rates, exemptions, & tips

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

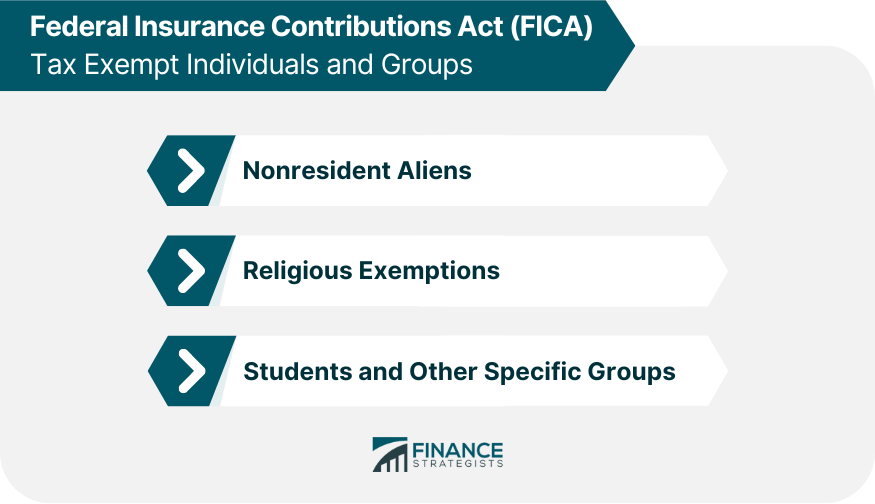

FICA Tax Exemption for Nonresident Aliens Explained

Understanding Payroll Taxes and Who Pays Them - SmartAsset

A Guide to Medicare Tax Rate for Small Business Owners (2023) - Shopify Canada

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

FICA Tax Rate 2023: What is it? Get detailed information about it! - NCBlpc

What are FICA Taxes? 2022-2023 Rates and Instructions

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

FICA Tax: What It is and How to Calculate It

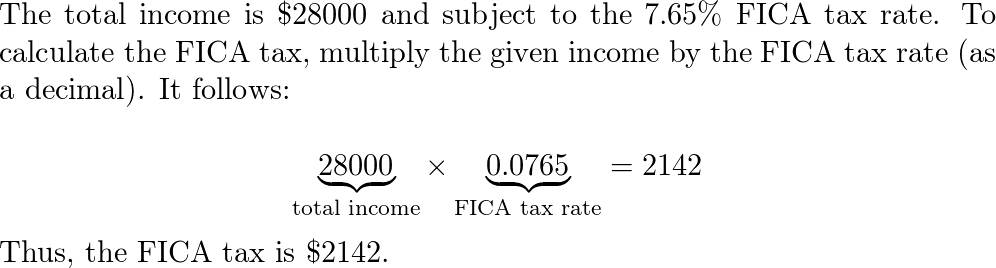

Calculate the FICA taxes and income taxes to obtain the tota

de

por adulto (o preço varia de acordo com o tamanho do grupo)