What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Descrição

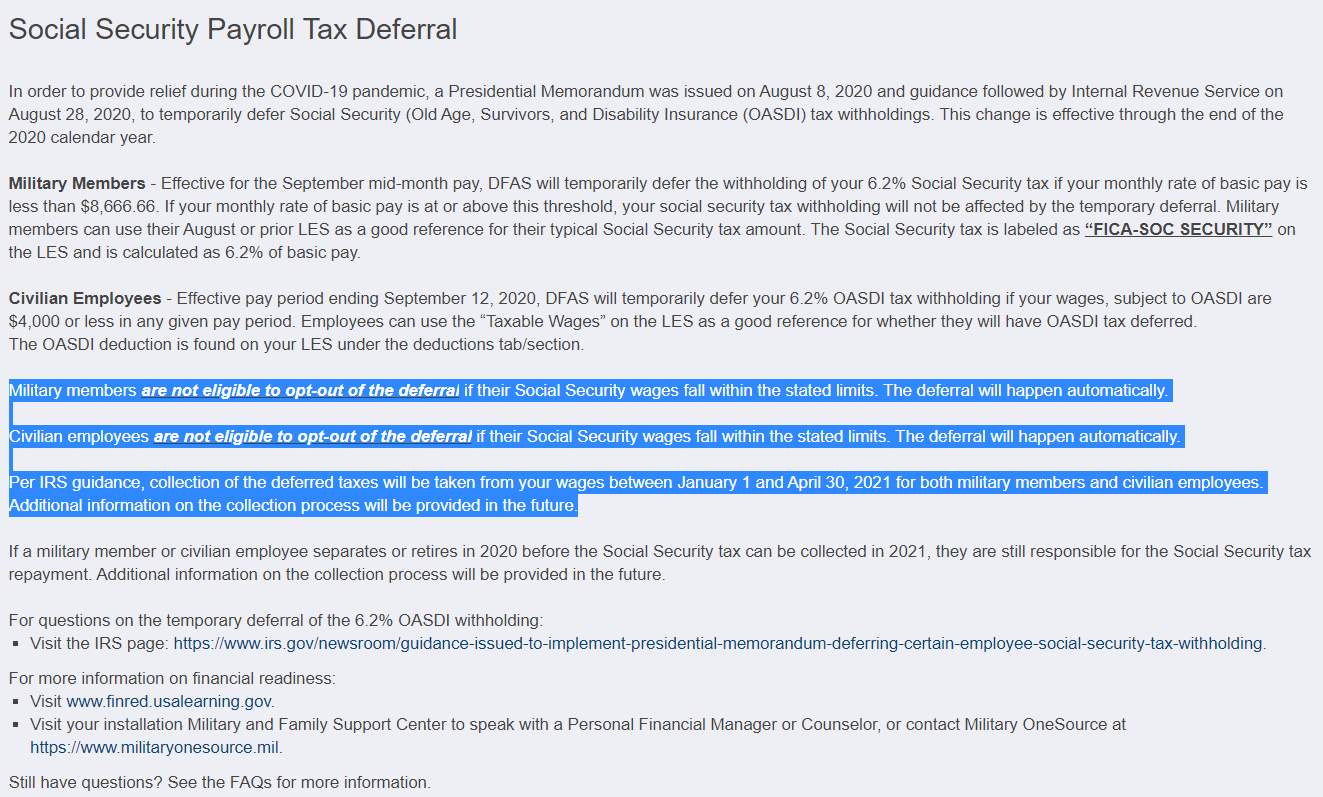

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

Pros & Cons of President Trump's Payroll Tax Deferral

Employee Payroll Tax Withholding Deferral - Burns White

Rep. Don Beyer on X: NEW: over Labor Day weekend the Trump Administration quietly confirmed it will subject the entire United States military to Trump's payroll tax scheme. They wrote: military members

IRS Updated Form 941 for COVID-19 Related Employment Tax Credits

How the Payroll Tax Deferral Impacts Military Members

How to see my deferred social security taxes — CARES Act – Help Center Home

37th Training Wing - Teammates, please see the below details regarding the OASDI Social Security Payroll Tax Withholding Deferral. The deferment is intended to provide temporary financial relief during the #COVID-19 pandemic.

Deadline Nears for Paying Deferred Social Security Taxes - NJBIA

Executive Order to Defer Social Security Taxes Unlikely to Affect Program Sustainability—But Social Security Reform Desperately Required, Payroll Tax Cut Possible

A reckoning for payroll tax deferrals - Journal of Accountancy

de

por adulto (o preço varia de acordo com o tamanho do grupo)